403b withdrawal tax calculator

403 b plans are only available for employees of certain non-profit tax-exempt organizations. If you are under 59 12 you may also.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

. And from then on. If you are under 59 12 you may also be. Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals.

If you treat all of the 90000 as CRD on Form 8915-E none of the 80000 will be subject to any early-distribution penalty and and. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. Individuals will have to pay income.

Calculate your earnings and more. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. Ad TIAA Can Help You Create A Retirement Plan For Your Future.

Expected Retirement Age This is the age at which you plan to retire. IRA401 k403 b Retirement Calculation. 501c 3 Corps including colleges universities schools.

Use this calculator to estimate how much in taxes you could owe if. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Retirement Plan Withdrawal Calculator.

Find out how much to put away tax deferred to get a certain amount of money in the future and how much you could expect to draw out of that. November 9 2020 550 PM. The 4 percent rule withdrawal strategy suggests that you should withdraw 4 percent of your investment account balance in your first year of retirement.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Under the new tax law effective for the 2018 tax year the tax rates have been lowered so youll pay less on your 403 b distributions. If you are under 59 12 you may also.

That will make me debt-free. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation. But your earnings and eventual.

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. I have a 403 b plan with about 325000 that I want to close when I retire in a year to pay off my mortgage student loans etc. The purpose of the 403b Savings Calculator is to illustrate how making contributions to this retirement account can help you to save for your retirement.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Tax Rates Lower in 2018.

Dont Wait To Get Started. A 403b plan also commonly referred to as a tax-sheltered annuity is a retirement plan available for employees who work for non-profit organizations public schools and ministries. Retirement Withdrawal Calculator Terms and Definitions.

Amount You Expected to Withdraw This is the budgeted.

What S The Difference Between 401 A And 403 B Plans

Retirement Income Calculator Faq

403b Withdrawal Rules Pay Tax On Retirement Income

The Cost Of Cashing Out Retirement Plans Early Equitable

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

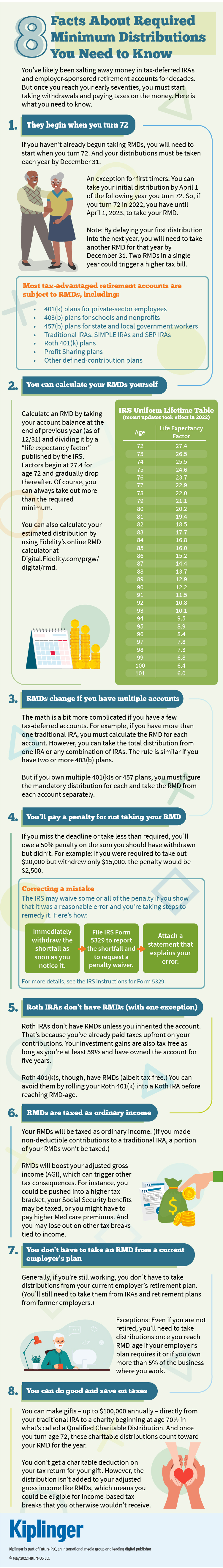

8 Facts About Required Minimum Distributions You Need To Know

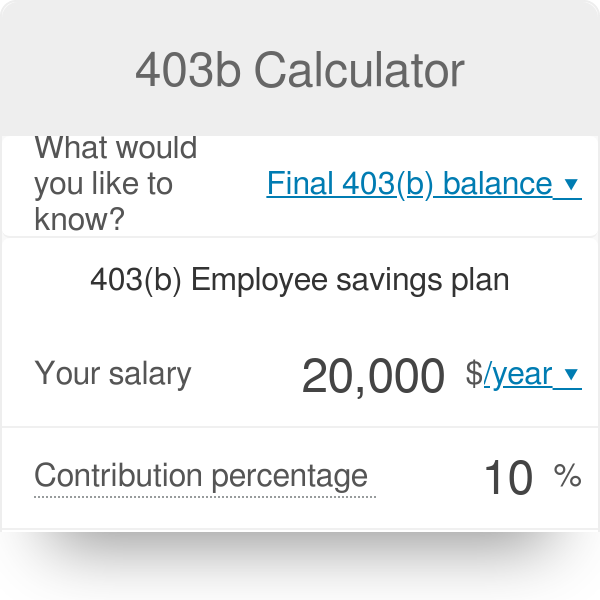

403b Calculator

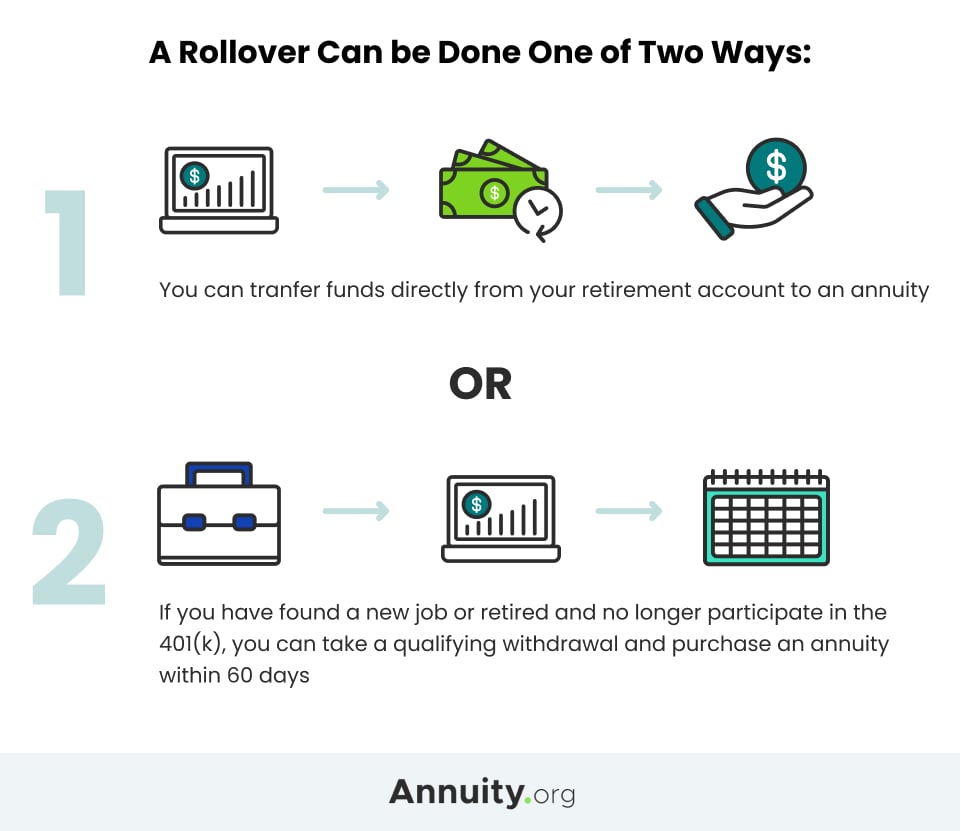

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Understanding 403 B Retirement Plans For Churches Non Profits And Schools

Withdrawing Money From An Annuity How To Avoid Penalties

2

Retirement Withdrawal Calculator

403 B Retirement Plan Questions And Answers About 403 B S

Roth 403 B Plans Rules Tax Benefits And More Smartasset

How Long Will My Retirement Savings Last Money Management Tips 2022

Can I Avoid Tax Hit On 403 B Withdrawal