Roth ira early withdrawal penalty calculator

An IRA CD can be three types. Applies to personal accounts only.

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Taking an early withdrawal from your 401k or IRA will result.

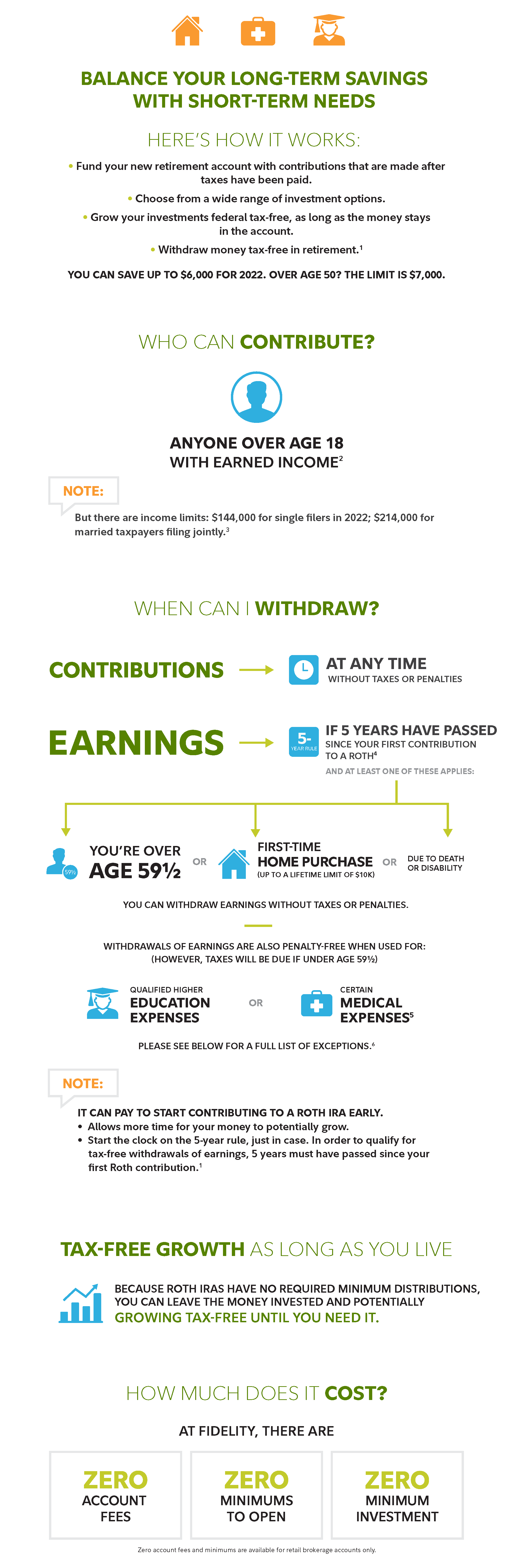

. Will be taxable in the year received. Withdrawals must be taken after age 59½. Only Roth IRAs offer tax-free withdrawals.

You can still take early withdrawals from a traditional IRA but youll be on the hook for income taxes and in most circumstances youll pay the IRS a 10 early withdrawal penalty. You havent met the five-year rule but youre over age 59 12. And the penalties and taxes you have to pay on that money depend on the type of retirement account it came from.

The 10 penalty can be waived however if you meet one of eight exceptions to the early-withdrawal penalty tax. Distributions Made to Beneficiaries. 401k and IRA distributions made to beneficiaries of plans inherited after death are generally not subject to the early withdrawal penalty.

Contributions are made using after-tax money. Withdraw up to a 10000 lifetime cap for a. Moving money from your traditional IRA to a Roth IRA is called a.

401k Withdrawing money from a 401k early comes with a 10 penalty. You wont have to pay the early-distribution penalty 10 additional tax on your Roth IRA withdrawal if all of these apply. Retirement Help and IRA Management.

See this month. Consult a financial advisor or tax professional for guidance. Traditional IRA with pre-tax money Roth IRA with after-tax money and tax-free earnings and SEP IRA for self-employed savers and small businesses.

The Roth IRA early withdrawal penalties primarily impact those under 59½. Withdrawals must be taken after a five-year holding period. Before converting a traditional 401k or IRA to a Roth 401k or IRA think about your future.

Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. View our IRA CD interest rates and calculator today. Minimum opening balance is 2500.

Before making a Roth IRA withdrawal keep in mind the following guidelines to avoid a potential 10 early withdrawal penalty. Contributions are made using after-tax money. Contributions may be made to both a Traditional IRA and a Roth IRA but the aggregate amount cannot exceed.

Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. First to avoid both income taxes and the 10 early withdrawal penalty you must have held a Roth IRA for at least five years. They can do this even though you roll over the investments.

While Roth IRAs are not intended to be a savings account Roth IRAs do allow you to withdraw funds without the 10 early withdrawal penalty. 401K and other retirement plans. 830 am 930 pm Eastern Time.

Once you turn age 59 12 you can withdraw any amount from your IRA. Birth or adoption expenses New parents can now withdraw up to 5000 from a retirement account to pay for birth andor adoption expenses penalty-free. If you withdraw money before age 59½ you will have to pay income tax and even a 10 penalty.

Roth IRA calculator. 2021 contribution limits capped at 6000 if under age 50. The income tax was paid when the money was deposited.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. As soon as those 60 days are up the money from the IRA is considered to be cashed out. If you withdraw your Roth IRA earnings before you reach age 59½ and before you meet the 5-year rule its considered an.

Distributed earnings will be included as income and subject to income taxes but they wont be subject to the 10 penalty tax. The amounts withdrawn arent more than your your spouses your childs andor your grandchilds qualified higher-education expenses paid during 2021. Where you will live in retirement leaving money to others and required minimum distributions RMDs.

Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors. Contributions are made using pre-tax money. One of the key benefits of a Roth IRA or Roth 401k is that while contributions arent tax-deductible both contributions and earnings can be withdrawn tax and penalty free once you reach age 59½.

Distributions from 401k plans and IRAs are exempt from the early withdrawal penalty if rolled over into another eligible retirement plan within 60 days. Also you may owe income tax in addition to the penalty. New IRAs and Rollovers Open an IRA or roll over a 401k 403b or governmental 457b plan to an IRA 1-877-493-4727 Mon Fri.

You can avoid an early withdrawal penalty if you use the funds to pay unreimbursed medical expenses that are more than 75 of your adjusted gross income AGI. Consider the costs of a conversion. If you return the cash to your IRA within 3 years you will not owe the tax payment.

Note that 401ks may have additional rules around withdrawals. This condition is satisfied if five years have passed since you first. A penalty may be charged for early withdrawal.

7000 if 50 or older. Some financial institutions might impose early withdrawal penalties on investments Ex. Converting your Traditional IRA to a Roth IRA.

Further you can take more than one penalty-free withdrawal to buy a home but there is a 10000 limit. Tax-free and penalty-free withdrawal on earnings can occur after the age of 59 ½. 401k traditional IRA or Roth IRA.

Contributions are made using pre-tax money. If you do a direct rollover you wont pay an IRS penalty. Ages younger than 59 ½ with a Roth IRA youve had more than five years you can avoid the penalty for early withdrawal and taxes on earnings if you.

How you would pay for it the 38 Medicare surtax and gains on company stock in a 401k. The early withdrawal penalty for a traditional or Roth individual retirement account IRA is 10 of the amount withdrawn. How to Withdraw From a Roth IRA Early Penalty-Free.

Roth IRA withdrawal rules allow you to take out up to 10000 earnings tax and penalty free as long as you use them for a first-time home purchase and you first contributed to a Roth account at. You can avoid the early withdrawal penalty by waiting until at least age 59 12 to start taking distributions from your IRA. On top of that the IRS will assess a 10 early.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

3 Retirement Times Retirement Calculator Retirement Money Retirement Savings Calculator

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

The Shockingly Simple Math Behind Early Retirement Money Mustache Early Retirement Simple Math

12 Ways To Avoid The Ira Early Withdrawal Penalty

Roth Ira Early Withdrawals What You Need To Know Nerdwallet

Iras 401 K S Other Retirement Plans Strategies For Taking Your Money Out By Twila Slesnick Phd Enrolled Agent Nolo Retirement Planning Money Book Enrolled Agent

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

Pin On Financial Independence App

Roth Ira Calculator Roth Ira Contribution

Three Fund Portfolio Bogleheads Investing Investing Strategy Budgeting Finances

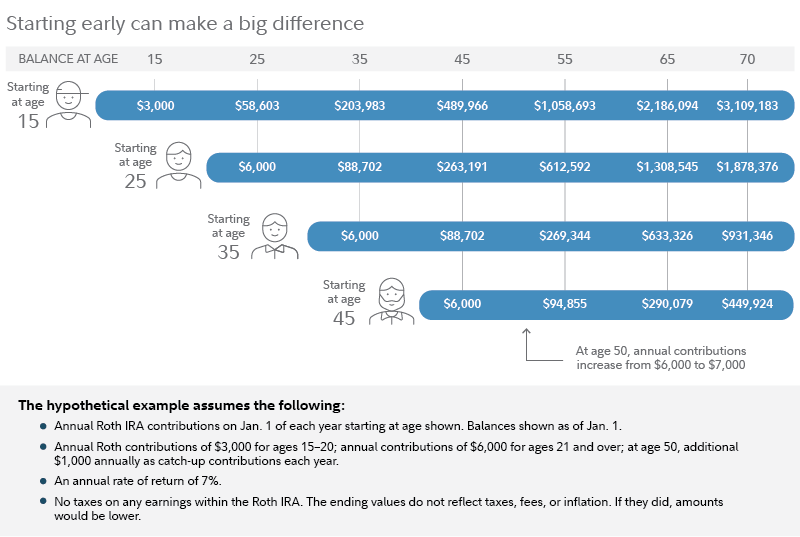

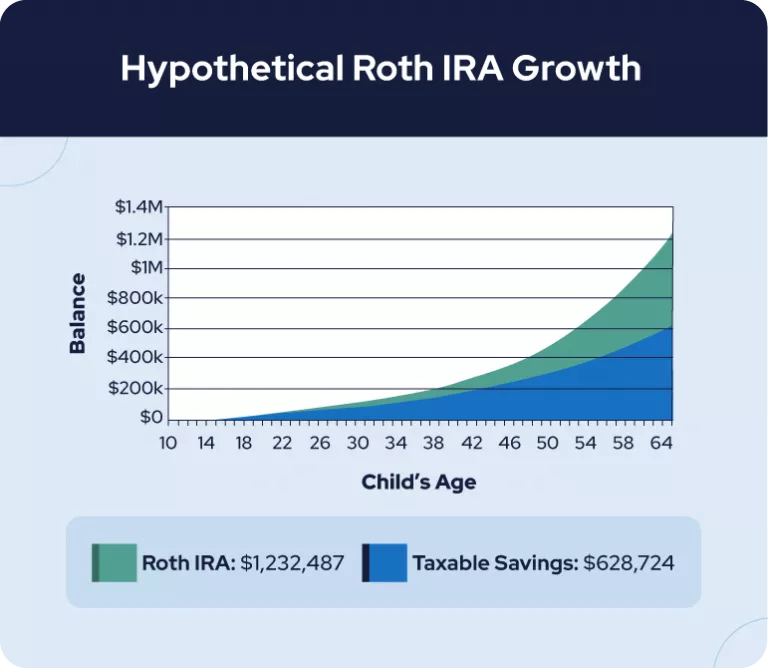

Save For The Future With A Roth Ira Fidelity

3jyzvuocctnujm

The Shockingly Simple Math Behind Early Retirement Money Mustache Early Retirement Simple Math

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

How To Figure Out The Taxable Amount Of An Ira Distribution 2022

Roth Ira For Kids Rules And Contributions Shared Economy Tax